The 5-Minute Rule for Transaction Advisory Services

Table of ContentsNot known Facts About Transaction Advisory ServicesFascination About Transaction Advisory ServicesAbout Transaction Advisory ServicesTransaction Advisory Services Things To Know Before You BuyTransaction Advisory Services Fundamentals Explained

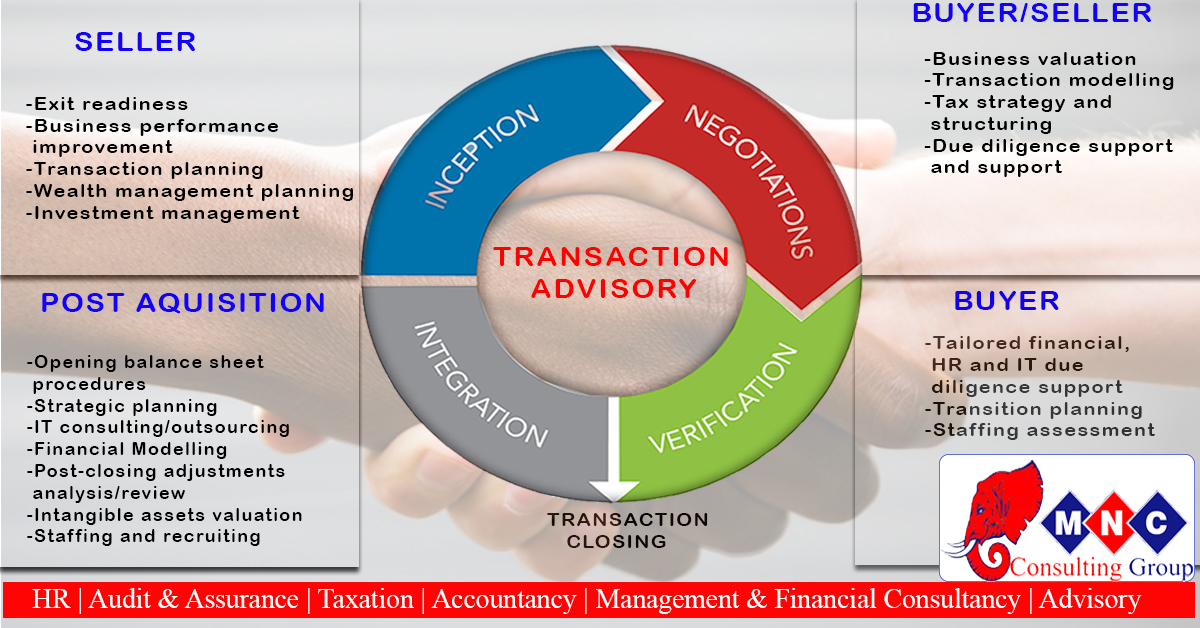

This step ensures business looks its ideal to possible purchasers. Getting the organization's worth right is crucial for a successful sale. Advisors use various techniques, like discounted capital (DCF) evaluation, comparing with comparable business, and recent purchases, to identify the fair market price. This helps set a fair rate and discuss successfully with future purchasers.Transaction experts step in to help by obtaining all the needed info organized, addressing concerns from buyers, and arranging sees to business's location. This constructs depend on with buyers and maintains the sale moving along. Obtaining the very best terms is key. Purchase consultants utilize their experience to assist local business owner take care of difficult negotiations, meet customer expectations, and framework offers that match the owner's objectives.

Satisfying lawful regulations is important in any kind of organization sale. They aid service proprietors in planning for their next steps, whether it's retired life, beginning a new venture, or handling their newly found wide range.

Purchase experts bring a riches of experience and understanding, making certain that every facet of the sale is taken care of properly. With calculated prep work, appraisal, and settlement, TAS helps business proprietors accomplish the greatest possible price. By making sure legal and governing compliance and handling due persistance alongside other bargain employee, transaction experts minimize possible dangers and responsibilities.

How Transaction Advisory Services can Save You Time, Stress, and Money.

By contrast, Big 4 TS groups: Deal with (e.g., when a possible customer is performing due diligence, or when a bargain is shutting and the buyer requires to incorporate the company and re-value the seller's Annual report). Are with charges that are not connected to the bargain shutting efficiently. Earn fees per engagement someplace in the, which is much less than what investment financial institutions earn also on "small offers" (yet the collection possibility is additionally much greater).

, however they'll focus much more on bookkeeping and appraisal and less on topics like LBO modeling., and "accounting professional only" topics like test balances and exactly how to stroll via occasions using debits and credit ratings rather than monetary declaration adjustments.

Some Known Incorrect Statements About Transaction Advisory Services

Professionals in the TS/ FDD groups may likewise speak with administration regarding whatever above, and they'll create a thorough record with their findings at the end of the process.

, and the basic shape looks like this: The entry-level function, where you do a lot of data and economic analysis (2 years for a promo from here). The next degree up; similar job, yet you get the even more interesting bits (3 years for a promo).

Specifically, it's tough to obtain promoted past the Supervisor level since couple of people leave the task at that phase, and you need to start revealing proof of your capability to generate revenue to advance. Allow's start with the hours and lifestyle since those are less complicated to define:. There are occasional late nights and weekend job, yet nothing like the frantic nature of investment financial.

There are cost-of-living changes, so expect reduced payment if you're in a cheaper place outside major monetary (Transaction Advisory Services). For all placements except Companion, the base salary comprises the mass of the overall settlement; the year-end benefit could be a max of 30% of your base wage. Frequently, the most effective way to boost your revenues is to change to a different company and negotiate for a higher income and incentive

The Definitive Guide for Transaction Advisory Services

You can enter advice into company advancement, but financial investment banking obtains more hard at this stage due to the fact that you'll be over-qualified for Analyst functions. Company financing is still an alternative. At this stage, you should just remain and make a run for a Partner-level role. If you wish to leave, perhaps relocate to a customer and perform their assessments and due diligence in-house.

The main trouble is that due to the fact that: You generally require to join another Large 4 team, such as audit, and work there for a few years and afterwards relocate into TS, work there for a couple of years and afterwards move right into IB. And there's still no assurance of winning this IB function due to the fact that it depends on your region, customers, and the working with market at the time.

Longer-term, there is also some danger of and since reviewing a company's historical monetary details is not precisely brain surgery. Yes, human beings will constantly require to be involved, but with advanced innovation, reduced head counts can potentially support client engagements. That said, the Deal Solutions team beats audit in terms of pay, work, and exit opportunities.

If you liked this write-up, you could be interested in reading.

Transaction Advisory Services for Dummies

Develop innovative monetary frameworks that help in determining the real market value of a firm. Provide consultatory job in connection to organization appraisal to aid in bargaining and rates structures. Describe one of the most suitable kind of the deal and the type of factor to consider to employ (money, supply, gain out, and others).

Create activity prepare for danger and direct exposure that have actually been determined. Execute integration planning to establish Visit This Link the process, system, and organizational modifications that might be required after the offer. Make mathematical price quotes of integration expenses and advantages to analyze the financial rationale of combination. Establish standards for incorporating divisions, innovations, and company procedures.

Determine prospective decreases by minimizing DPO, DIO, and DSO. Assess the possible consumer base, sector verticals, get redirected here and sales cycle. Take into consideration the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance uses crucial understandings right into the functioning of the firm to be acquired concerning risk analysis and worth production. Identify short-term adjustments to financial resources, financial institutions, and systems.